This week, I was privileged to attend a presentation by Leslie Appleton-Young. Leslie is the Vice President of California Association of Realtors and their Chief Economist.

I have never heard Leslie speak before and was surprised with her vibrant personality and down to earth style. it’s always hard to deliver bad news to a room full of Pasadena realtors, but she did with style and ease.

It turns out that Leslie is a resident of Pasadena and has been living in our community for the last year and a half. Pretty exciting for me since I’m hoping that I’ll run into her one day at Pete’s and will have an opportunity to pick her brain a bit. 😀

I will be writing a post over the next few days to share my thoughts on real estate market expectations for 2009 in Pasadena, but in the meantime, here’s what Leslie shared with the real estate community.

November 2009 UPDATE – Read the newly posted 2010 California Real Estate Forecast

Personal Consumption:

American consumers have been spending more and saving less. For the first time since 1992, personal consumption dropped. Simply, this means that people buy less which causes employers to cut back jobs.

California is losing more jobs on average – California’s unemployment rate in August 2008 was 7.7% while United States as a whole was 6.1% in September 2008.

California Housing Permits:

New Housing Permits are down by 45.1% year to date in California – under 50,000 units compared to over 100,000 in 2007. Builders are waiting for the existing inventory to be absorbed.

National Economy Outlook through 2009:

- Recession through mid–2009

- Improved outlook in second half 2009

- Weak job picture, unemployment rate up

- Inflation no longer a concern – for now

- Stimulus package all but certain in early 2009

- CRITICAL CONCERN: How soon will financial system stabilize and enable economic activity to return to normal?

California Housing Statistics:

California home prices peaked in May of 2007 at $594,530. In September of 2008, overall median home sales price was at $316,480 a 46.8% drop.

In 2005, home sellers walked away with a median net cash of $220,000 from a sale of a property. Year to Date, 2008, median net cash to home sellers is $100,000. A drop of $120,000 in home equity.

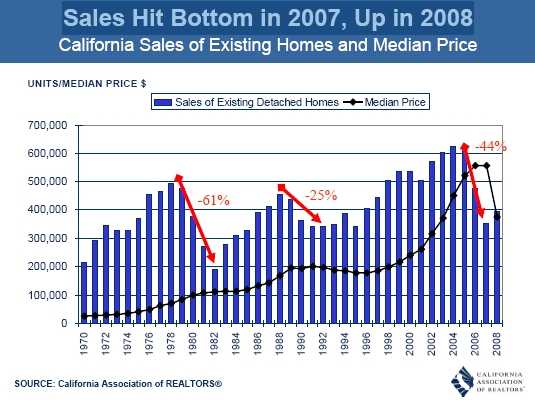

Sales Hit Bottom in 2007, Up in 2008

The reason for the upswing in 2008 is due mainly to sellers being in distressed. This is providing opportunities for real estate investors.

California homes in lower price ranges are being hit the hardest due to lack of liquidity. Banks are making it more difficult to get loans and are requiring larger down payments. Median prices of homes under $500,000 dropped 27.7%.

California homes over $1 million are adversely affected by lack of available financing and the lackluster performance of the stock market.

Overall, unsold home inventory in California as of September of 2008 is at 6.5 months supply.

First Time Home Buyer Affordability:

First time home buyer affordability is moving up for California home buyers. 2nd quarter of 2008, California first time home buyer affordability was a bit under 50% up from 23% from 3rd quarter of 2007.

When interviewed buyers state the following reasons for buying homes:

- Price decreases motivated us

- Low interest rates helped us move to a

- Better location, neighborhood

- Likelihood that interest rates will move up

In 2006, 40% of 1st time home buyers were able to secure 100% financing on the purchase of their home. This year only 5.7% of first time home buyers are able to get full financing.

FORECLOSURES:

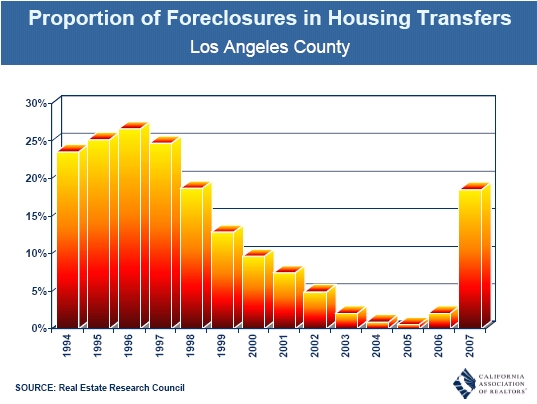

Too many home owners dipped into their equity and refinanced their homes. A lot of refinancing involved moving from a fixed 30 year loan to an adjustable rate mortgage (ARM). As these loans matured, home owners could not afford to make payments and their homes went into foreclosure.

In Los Angeles county, most of these “ARM” loans are due in 2008 and 2009. A lot of the home sellers have already sold or refinanced these homes or hired real estate agents to negotiate a “short sale” with the bank.

Here’s a nice visual of the proportion of foreclosures to sales transfers:

FINAL WORDS:

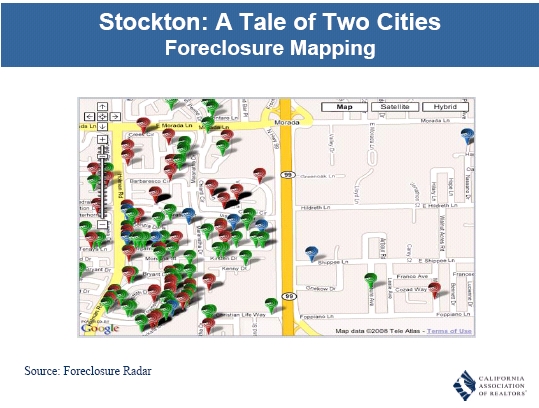

Leslie ended her presentation stating that real estate is very local. Los Angeles County and California statistics can not be applied across the board to individiual neighborhoods. As an example, she provided a slide of Stockton and called it her “tale of two cities”. See for yourself:

Almost all of the foreclosures are West of 99 and just a handful East of the freeway.

Take a look at these lists of foreclosures for the following cities and you will see how few we actually have in and around Pasadena:

Pasadena list of foreclosure homes

South Pasadena list of foreclosure homes

Altadena list of foreclosure homes

Alhambra list of foreclosure homes

Stay tuned for my forecast of Pasadena real estate market for 2009. In the meantime, I’d love to hear your thoughts and perspectives.

READ MORE: Pasadena Real Estate Market is on the Rebound – March 2009 Real Estate Housing Report

PASADENA REAL ESTATE GUIDE – everything you need to know about buying or selling a home in Pasadena.

If you are interested in selling your home, call Irina Netchaev at 626-627-7107 for a private consultation.