“LIVE EACH SEASON AS IT PASSES.” Henry David Thoreau

Last week saw the start of earnings season for the fourth quarter of 2008, and this is likely to be one earnings season everyone hopes passes quickly.

The beleaguered banking sector was in the spotlight throughout the week, as Citigroup reported an $8.29 Billion loss, completing its worst year ever since its inception in 1812. Bank of America also lost $1.79 Billion in the fourth quarter, making 2008 the bank’s first yearly loss in 17 years. And the news extended overseas as Deutsche Bank, which is Germany’s largest bank, warned of a fourth-quarter loss of $6.3 Billion.

READ MORE: World’s Safest Banks for 2008

There were a few bright spots to note during the week, however, as JP Morgan Chase surprised the market with an earnings report that beat expectations…it’s been awhile since a financial Stock actually surprised to the good side! In addition, Bank of America received a lifeline of $138 Billion from the government’s $700 Billion rescue fund to help absorb their purchase of Merrill Lynch.

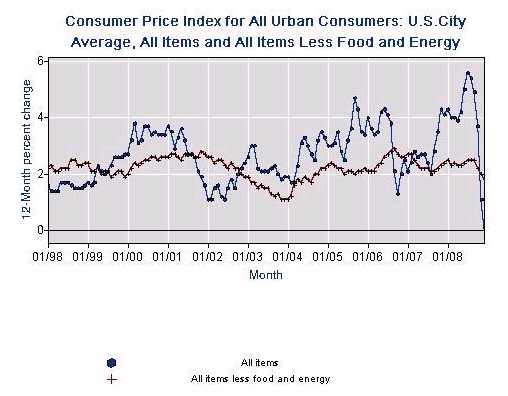

And in inflation – or lack thereof – headlines, the Consumer Price Index for 2008 was reported the lowest since 1954, indicating that inflation is definitely not a threat at this time. The chart below shows how consumer inflation has behaved over the past decade. The blue line with dots shows overall inflation rates, while the black line with crosses shows “core” inflation, which removes volatile food and energy costs. Note how the blue dotted line drops sharply on the far right side of the chart, showing the impact of lower oil prices on overall inflation.

So what did all the news of the week mean for Bonds and Pasadena Home loan rates? They did manage to hold steady for most of the week as Stocks struggled with the barrage of poor earnings reports…but when Stocks rebounded on Friday, Bonds and Pasadena home loan rates worsened, leaving rates at least .125% worse than where they began the week.

Remember, while Bonds and home loan rates are still at historic levels, there will be some volatile changes due to the many variables affecting the markets. It’s more important than ever to have an advice-based strategy when it comes to your Pasadena home loan.

Forecast for the week:

It’s a holiday shortened week in store, as the Bond market will be closed on Monday in honor of the Martin Luther King holiday. And it’s a quiet week when it comes to scheduled economic reports being delivered…but don’t expect it to be a quiet week overall as earnings season continues. And the inaugural events in Washington may also impact the activity of the week!

But in the way of economic reports, we will get a read on the new construction housing market with Thursday’s Housing Starts and Building Permits Reports, neither of which is expected to be blockbusters. And given the current job market, Thursday’s weekly Jobless Claims Report will be one to watch as well.

Remember: Weak economic news normally helps Bonds and home loan rates improve, as money flows out of Stocks and into Bonds.

I will be watching very closely to see how Bonds and rates respond to the news of the week.

Economic Calendar for the week of January 19 – January 23, 2009

| Date | ET | Economic Report | For | Estimate | Actual | Prior | Impact |

| 1/22/2009 | 8:30 | Building Permits | Dec | 615K | 616K | Moderate | |

| 1/22/2009 | 8:30 | Housing Starts | Dec | 610K | 625K | Moderate | |

| 1/22/2009 | 8:30 | Jobless Claims (Initial) | 17-Jan | 548K | 524K | Moderate | |

| 1/22/2009 | 11:00 | Crude Inventories | 16-Jan | NA | 1.14M | Moderate |

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is not without errors.

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is not without errors.